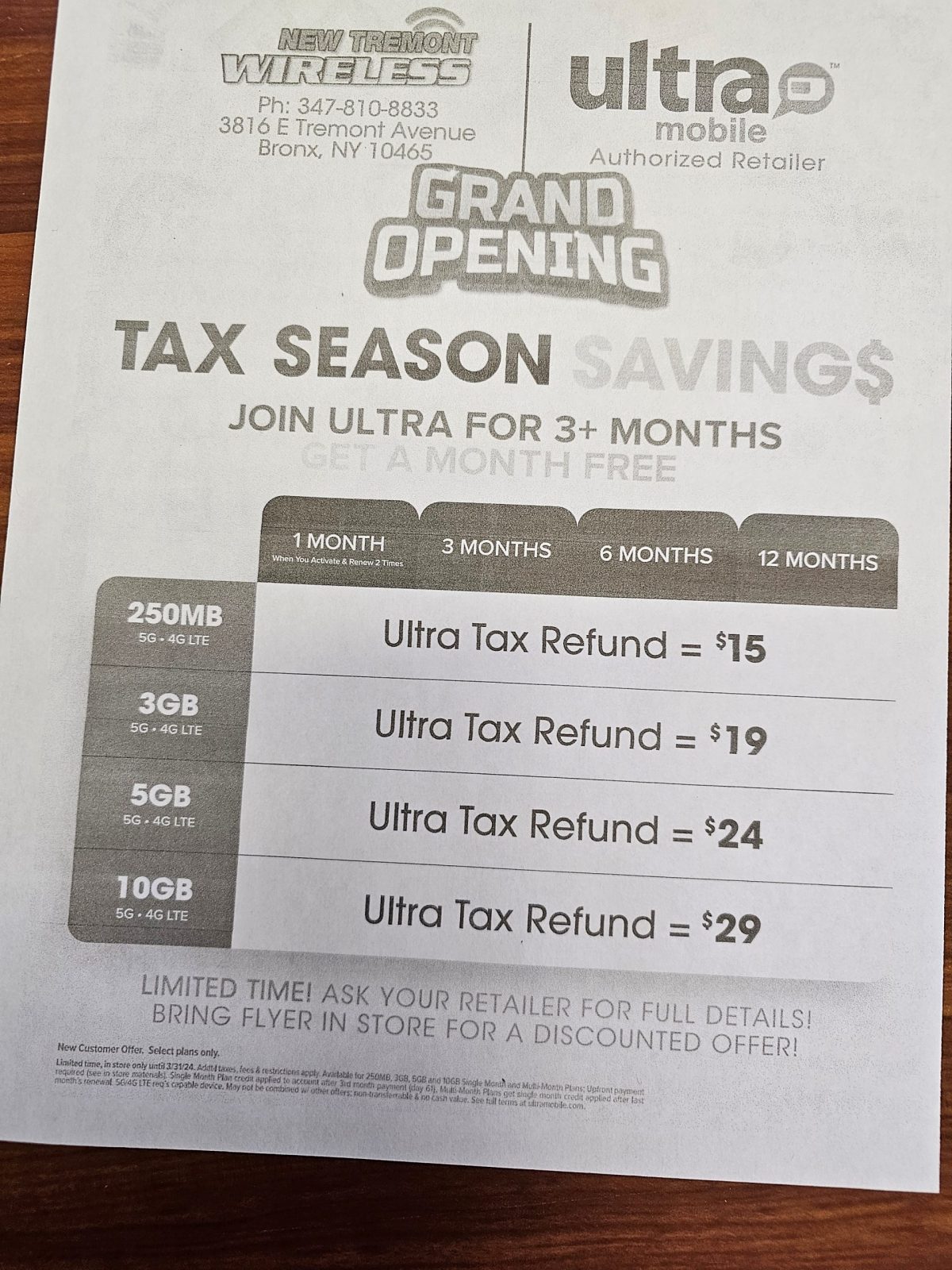

New Tremont Wireless has opened at 3816 East Tremont Avenue. You can reach them at 347-810-8833. Thy are featuring “Tax Season Savings right now! See the attached illustration for details.

New Tremont Wireless

New Tremont Wireless has opened at 3816 East Tremont Avenue. You can reach them at 347-810-8833. Thy are featuring “Tax Season Savings right now! See the attached illustration for details.

A new consumer protection law has gone into effect on February 11, 2024. This new law will amend and clarify New York’s existing credit card surcharge law. The.

The law, signed by Governor Hochul on December 13, 2023, provides: Limiting credit card surcharges to the amount charged to the business by the credit card company; and

The following practices and examples comply with the law’s credit card surcharge notice requirements. See the Department’s Credit Card Surcharge Guidance Document and educational video for additional examples:

DO:

DON’T:

NOTE: This law does not apply to debit cards.

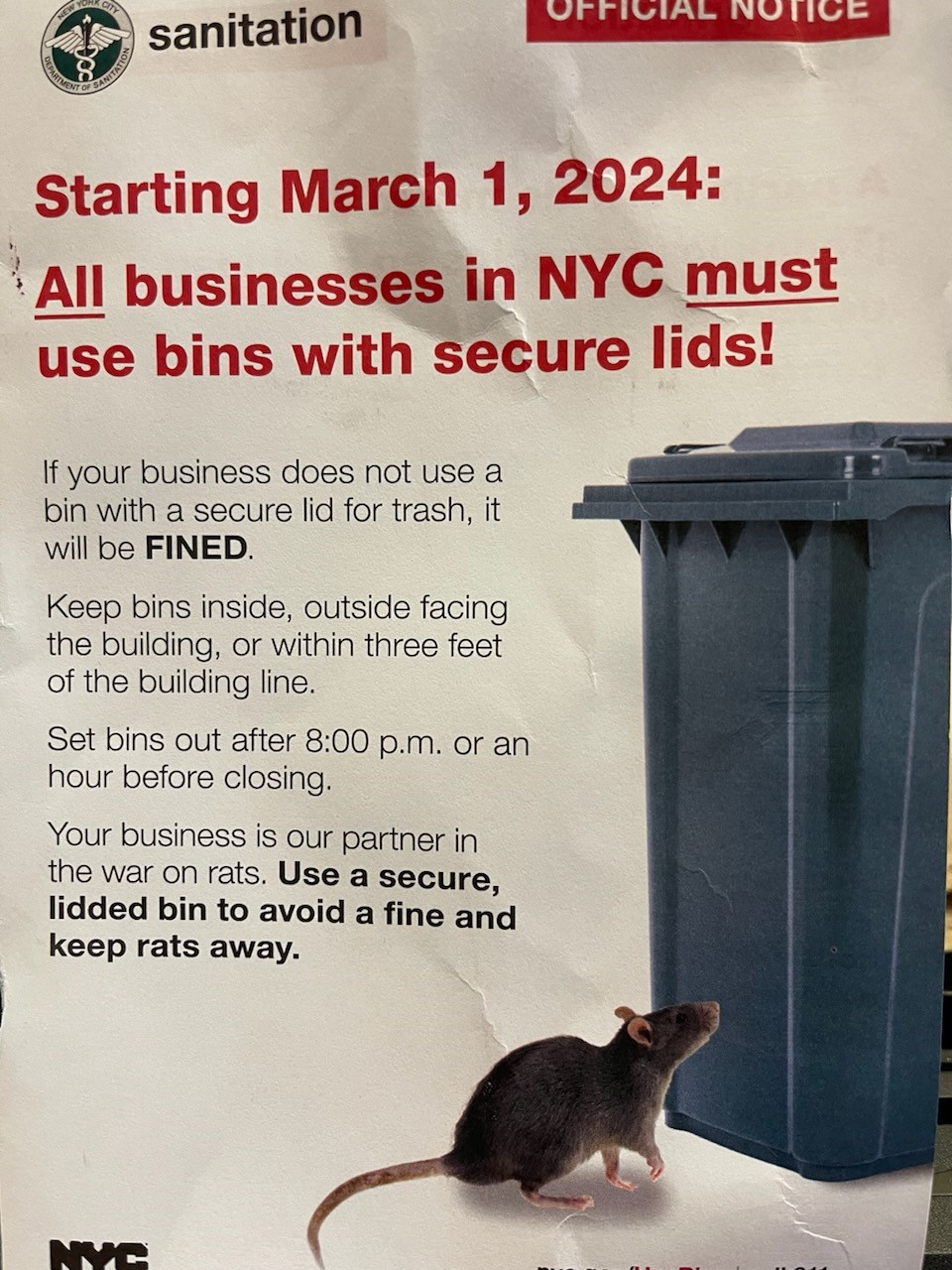

Waste Containerization for All Businesses Starts March 1 – Starting March 1, 2024, all businesses in NYC must use bins with secure lids when setting out trash for collection. This rule applies to any business in New York City, regardless of what is sold. Any perishable material (trash or organic material) must be in a bin with a secure lid when set out on the curb for collection. This requirement does not apply to recyclables (metal, glass, plastic, or paper) or to businesses that have waste collected from a loading dock. Please go to nyc.gov/usebins for more information

New York City Mayor Eric Adams, New York City Police Department (NYPD) Commissioner Edward A. Caban, New York City Department of Small Business Services (SBS) Commissioner Kevin D. Kim, and New York City Office of Nightlife (ONL) Executive Director Jeffrey Garcia have announced the launch of “Coordinating a United Resolution with Establishments” (CURE) – a new process for NYPD, SBS, and ONL to improve public safety responses to nightlife establishments and more equitably engage with nightlife business owners.

The new CURE process replaces the NYPD’s “Multi-Agency Response to Community Hotspots” (MARCH) The new CURE process requires precincts to establish direct, in-person communication with business owners and managers in conjunction with ONL, making them aware of potential violations and conditions of concern, and providing multiple opportunities for local business owners to correct issues before enforcement actions are taken.

In cases involving complaints from local residents, ONL’s Mediating Establishment and Neighborhood Disputes NYC free mediation program will be engaged to help improve neighborhood relations through the support of neutral, third-party mediation. The program is administered in partnership with the New York City Office of Administrative Trials and Hearings.

As part of the new procedure, NYPD will not initiate city or state interagency inspections outside of the new CURE process. Only agencies relevant to issues observed at CURE-involved establishments may be included in joint-inspection operations with the NYPD, and only on an “as-needed” basis. This procedure does not limit NYPD from any necessary real-time response to address immediate public safety concerns. Furthermore, agencies that have previously participated in MARCH operations, such as the FDNY, DOB, DOHMH, DEP, and SLA will continue to maintain their regular independent inspection processes to maintain compliance and ensure safety.

For more information, go to https://nyc-business.nyc.gov/nycbusiness/business-services/legal-assistance/mediating-establishment-and-neighbor-disputes-mend-nyc

Two new Board members, Dr. Robyn Burchman and Jonathon Polanco, were elected to the Board of the Throggs Neck BID at our recent Annual Meeting. In addition, Newly elected Council Member Kristy Marmorato has appointed Renato Scalvo to represent her at Board meetings.

Dr. Robyn Burchman DMD is a widely respected dentist. She has served the Throggs Neck community for decades.

Renata Scalvo represents newly elected Council Member Kristy Marmorato, who has pledged to do all she can for our community.

Jonathon Polanco is the head of Polanco Wealth Strategies. He is dedicated to helping individuals and businesses build their financial futures.

Photo: From left to right: Renata Scalvo, Dr. Burchman, Jonathon Polanco

Restart of IRS Collection Notices in 2024 – The IRS will resume issuing collection notices for 2020 and 2021 beginning in January. Eligible taxpayers will also receive automatic abatement of any failure-to-pay penalties. Notice 2024-07 provides automatic relief to eligible taxpayers from the additions to tax for the failure to pay with respect to certain income tax returns for 2020 and 2021.

For eligible taxpayers, these additions to tax will be waived or, to the extent previously assessed or paid, will be abated, refunded, or credited to other outstanding tax liabilities, as appropriate, for the relief period, which begins on the date the IRS issued an initial balance due notice or February 5, 2022, whichever is later, and ends on March 31, 2024. Read more here.

New IRS Voluntary Disclosure Program Lets Employers Who Received Questionable Employee Retention Credits Pay Back at Discounted Rate – As part of an ongoing initiative aimed at combating dubious Employee Retention Credit (ERC) claims, the Internal Revenue Service has launched a new Voluntary Disclosure Program to help businesses who want to pay back the money they received after filing ERC claims in error.

The new disclosure program, which has been in the works for several months, is part of a larger effort at the IRS to stop aggressive marketing around ERC that misled some employers into filing claims. The special disclosure program runs through March 22, 2024, and the IRS added provisions allowing repayment of 80% of the claim received. Read more here

Open Storefronts – New York City’s Open Storefronts Program has expired and is no longer in effect. Any businesses that participated in the program are required to abide by all City laws and rules related to the use of sidewalks and public streets. There are alternatives to activating public space, and the Department of Small Business Services is available to answer any questions regarding the City’s laws and regulations at 888-SBS-4NYC.

Governor Hochul has signed the “LLC Transparency Act.” The measure

forces LLCs to list their “beneficial owners” when creating a company

or changing a company’s structure. The information will not be available

to the public.

NYC Free Tax Prep for Self-Employed Filers provides free tax preparation services, workshops, and one-on-one consultations for gig workers, freelancers and small business owners who often face barriers to filing taxes and managing financial recordkeeping. Find out more at https://www.nyc.gov/site/dca/consumers/file-your-taxes.page

Chairman Anthony Basso, Executive Director Bob Jaen, the Board of Directors and staff of the Throggs Neck BID wish you a Happy, healthy, and prosperous New Year!

NY DOL has finalized new rates for minimum wage, tip credit, meal credit, uniform maintenance pay and exempt employee salary thresholds, effective with the start of the new year. The new rates are summarized by Fox Rothchild at

https://www.foxrothschild.com/publications/ny-dol-issues-proposed-adjustments-to-the-tip-credit-in-accordance-with-the-upcoming-increase-in-minimum-wage

Timothy A. Gumaer, Glenn S. Grindlinger and Carolyn D. Richmond from that firm

https://www.foxrothschild.com/publications/ny-dol-finalizes-changes-to-tip-credit-meal-credit-uniform-maintenance-pay-and-exempt-employee-salary-thresholds report that “For non-exempt (i.e., hourly) employees, employers should prepare new rate of pay forms that accurately reflect the new minimum wage and any changes to the tip credit and/or meal credit, where applicable.

“Employers must also be aware of the changes to uniform maintenance pay and be ready to comply with those new rates where necessary. Employers should also work with their payroll providers to ensure that their pay stubs accurately reflect these changes.For exempt (i.e., salaried) employees, employers should review these new salary requirements and ensure that those employees are being paid at least the new minimum weekly amount. However, as a reminder, the salary threshold is only one part in determining whether an employee is properly categorized as exempt from overtime requirements; these employees must also perform particular duties to also be exempt from overtime, depending on their position.

“Employers should thus take the time to review those duties performed by their exempt employees to ensure that they are appropriately categorized as being exempt from overtime requirements.”